AI is Eating Clicks — Here’s the Visibility Strategy That Still Works

AI is quietly changing how discovery works.

Not because “SEO is dead,” but because more buyer research is getting compressed into a single answer – inside ChatGPT, Gemini, Perplexity, Copilot, and increasingly inside Google’s AI experiences.

A business owner on Reddit described the shift well: you can rank #1 on Google and still be invisible when someone asks an AI assistant which vendors to consider.

So the real question for growth teams is no longer

“Should we do SEO or AI visibility?”

It’s: Should we invest in being a brand that AI systems can confidently recommend and cite?

For most US-focused brands: yes, selectively and systematically.

This guide breaks down:

- what “AI visibility” means,

- the data behind why it matters,

- and a practical plan (with industry-specific playbooks for B2B SaaS, BFSI, and FMCG).

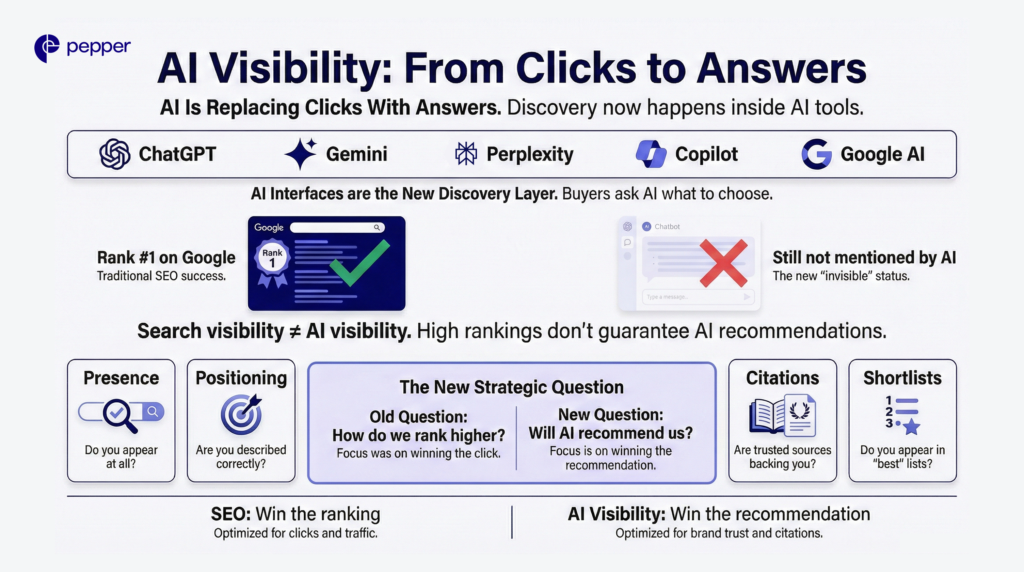

AI visibility, defined

AI visibilityis your brand’s presence + positioninginside AI-generated answers for your category and buyer-intent prompts.

It includes four measurable things:

- Presence: Do you show up at all for category prompts?

- Positioning: Are you described accurately?

- Citations/grounding: Are reputable sources backing that answer?

- Shortlists: Do you appear in “best tools / top options / recommended brands” answers?

This is different from classic SEO, where the primary goal is ranking links. In AI interfaces, the goal is often to be included in the answer.

Why invest now (U.S. market reality)

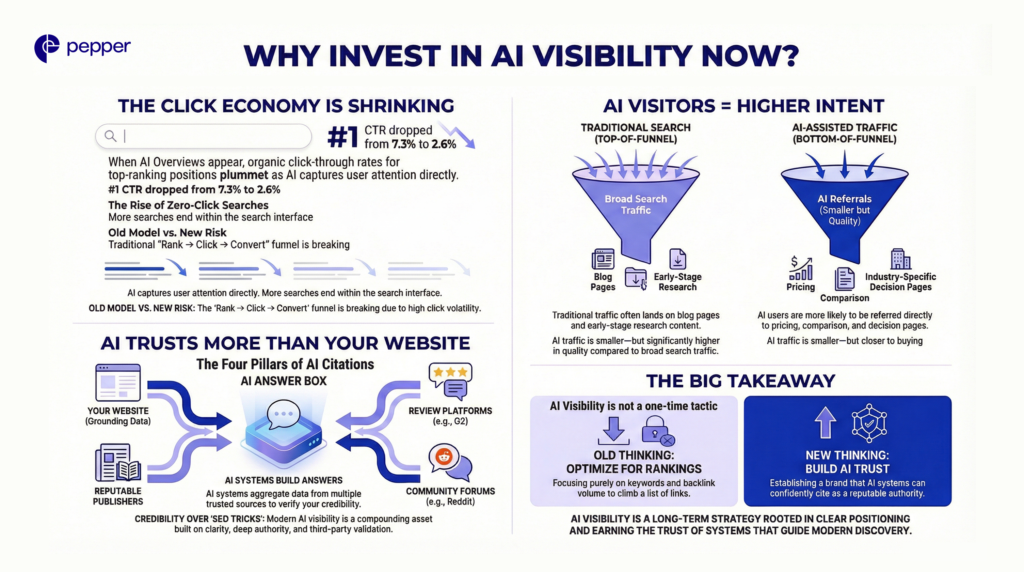

1) The click economy is getting squeezed

Even before AI Overviews scaled, U.S. Google search was already heavily zero-click—many searches end without a visit to any website.

AI experiences amplify that. Multiple studies and analyses have found that when AI Overviews appear, organic click-through rates can drop meaningfully, including reports showing #1 CTR on AIO queries falling from 7.3% (March 2024)to 2.6% (March 2025).

Implication:If your strategy is still “rank → get click → convert,” you’ll feel more volatility-especially on non-brand queries.

2) AI referrals are smaller than search, but often higher-intent

One of the most consistent patterns teams are seeing: AI-assisted visitors tend to land on decision pages(pricing, comparisons, industry pages), not only top-of-funnel blogs.

Implication:AI visibility is not just branding. It can affect the pipeline.

3) “Being citable” depends on more than your site

AI answers often pull from a mix of:

- your site,

- reputable publishers,

- review sites/directories,

- and community sources (including Reddit in some categories).

As Eli Schwartz has pointed out, chasing “hacks” to be cited is the wrong game—AI systems tend to reflect what a human would trust as evidence that you’re credible.

Lily Ray’s analysis of AI Overview citations adds an important nuance: Google appears to associate sites with a core set of topicsand may cite “topically relevant” sites multiple times when the query matches that topic cluster.

Implication:AI visibility is a compounding asset built on clarity, topical authority, and third-party trust—not a one-off optimization.

Should you invest? A quick decision framework

Invest now if you check 2+ boxes:

- You sell a high-consideration product (longer evaluation cycle)

- You’re in a crowded category (buyers want shortlists)

- You rely heavily on non-brand organic for the pipeline

- Trust/compliance is a differentiator (finance, security, healthcare)

- Your buyers are in the U.S. mid-market/enterprise (AI usage in research is rising fastest here)

Move slower (but don’t ignore it) if:

- Your category is mostly an impulse purchase

- You’re extremely local and maps-driven

- Your fundamentals are weak (unclear positioning, poor conversion pages, thin proof)

The best move for most brands:start with a focused pilotyou can measure.

What to measure (simple KPIs you can run monthly)

AI visibility KPIs:

- Prompt share of voice: % of your target prompts where you appear

- Accuracy score: are you described correctly? (Yes/No + notes)

- Citation quality: are citations reputable + relevant?

- Shortlist rate: how often you’re named in “best / top / recommended” lists

- Decision-page readiness: when AI sends traffic, do those pages answer the next 5 questions?

If your brand shows up but is described incorrectly, that’s not visibility—that’s risk(especially in BFSI).

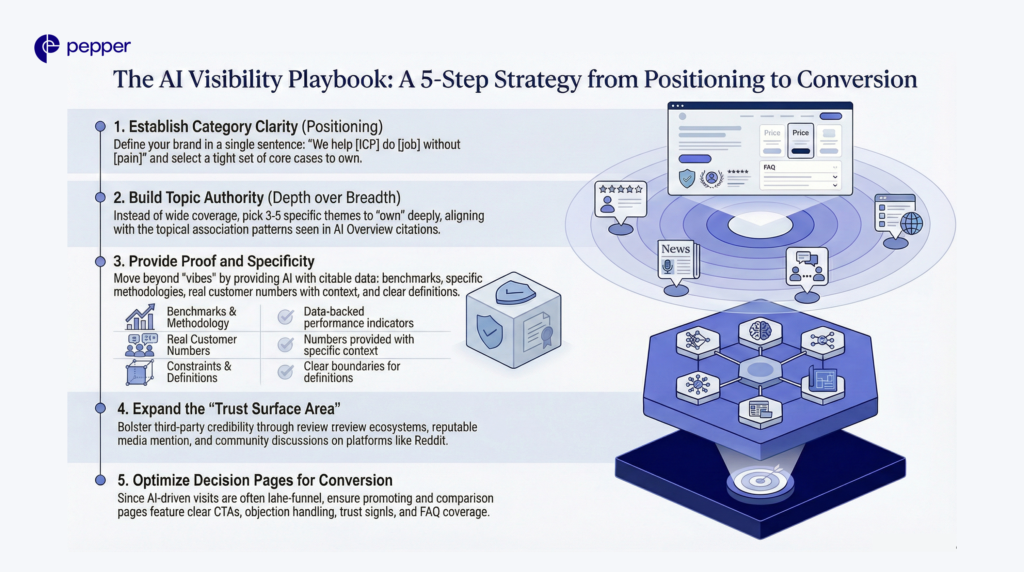

The AI visibility stack (what to invest in, in order)

This is the “playbook” part—what teams can actually do.

1) Category clarity (positioning)

- One sentence: “We help [ICP] do [job] without [pain].”

- A tight set of use cases you want to be associated with.

2) Topic authority (depth > breadth)

Pick 3–5 themes you want to “own,” then go deep. This aligns with the topical association pattern seen in AI Overview citations.

3) Proof and specificity (AI can’t cite vibes)

- benchmarks, methodology, examples

- real customer numbers (with context)

- clear definitions and constraints

4) Third-party credibility (the “trust surface area”)

- review ecosystems, directories, partner pages

- reputable media mentions

- community discussions where relevant (including Reddit in some categories)

5) Decision pages that convert

Because AI-driven visits often land late-funnel, your industry/pricing/comparison pages need:

- clear CTAs,

- objection handling,

- trust signals,

- and FAQ coverage.

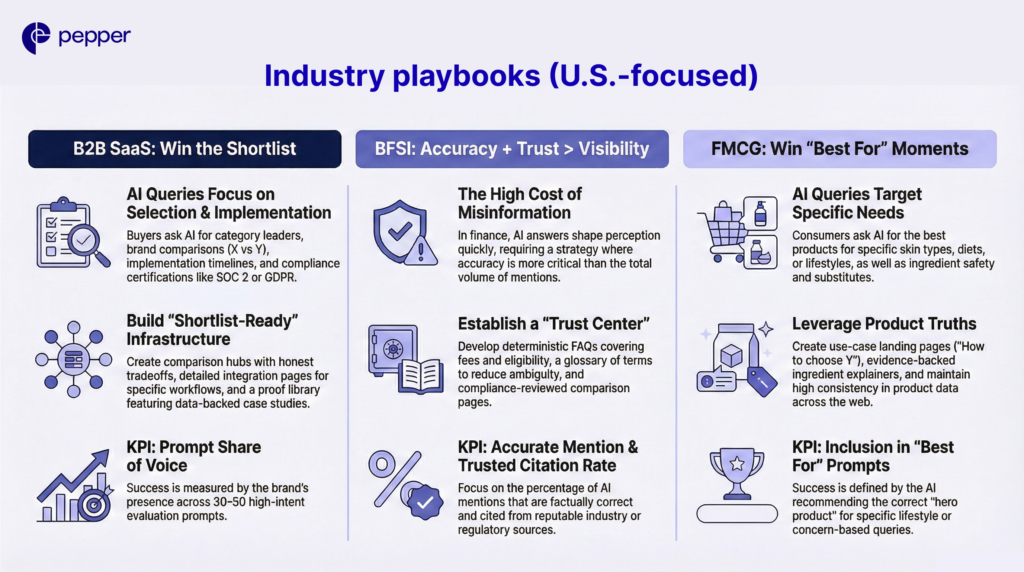

Industry playbooks (U.S.-focused)

A) B2B SaaS: win the shortlist

What buyers ask AI:

- “best [category] for [ICP]”

- “[Brand] vs [Competitor]”

- “alternatives to [Category Leader]”

- “how long does implementation take?”

- “is it SOC 2 / GDPR compliant?”

What to build:

- Comparison hub: “X vs Y,” “Alternatives,” “Best for” (with honest tradeoffs)

- Implementation guides: timelines, roles, steps, gotchas

- Integration pages: specific workflows, not generic partner logos

- Proof library: case studies with numbers and constraints

Where to earn citations:

- G2/Capterra-style review profiles, partner ecosystems, reputable newsletters/publications, and niche communities.

Best KPI:Prompt share of voice on 30–50 evaluation prompts.

B) BFSI: accuracy + trust > visibility volume

Finance is a category where AI answers can shape perception quickly—and the cost of misinformation is high.

What buyers ask AI:

- “Is [product] safe/legit?”

- “fees, eligibility, terms”

- “claim process / dispute handling”

- “what happens if…?”

What to build:

- Trust center: licensing, security, compliance, audits, governance

- Deterministic FAQs: fees, eligibility, timelines, exclusions

- Glossary + explainers: clear definitions that reduce ambiguity

- Comparison pages: (careful, factual, compliance-reviewed)

Where to earn citations:

- reputable publishers, industry associations, regulator references where applicable

Best KPI:“Accurate mention rate” + “trusted citation rate” (not just presence).

C) FMCG: win “best for” moments with product truth

What buyers ask AI:

- “best for [skin type / concern / diet / lifestyle]”

- “ingredient comparisons”

- “is this safe / allergen-friendly / cruelty-free?”

- “what’s a substitute for…?”

What to build:

- Use-case landing pages: “best for X,” “how to choose Y”

- Ingredient/benefit explainers: plain-English and evidence-backed

- Claims pages: testing summaries, certifications, sourcing

- Product data consistency: names, variants, ingredients, availability

Where to earn citations:

- credible editorial reviews, retailer pages, category directories, community discussions

Best KPI:Inclusion in “best for” prompts with the righthero product + correct claims.

A 30-day starter plan (minimal viable investment)

Week 1: Baseline audit (30–50 prompts)

Build a prompt set across:

- category discovery

- comparisons

- pricing/ROI

- implementation

- trust/safety

Record: do you show up?, how are you described?, who gets cited?

Week 2: Close the top 10 gaps (on-site)

Create or upgrade:

- 2 comparison pages

- 2 implementation/how-to pages

- 2 industry pages

- 1 trust/FAQ hub

- 3 “single-question” pages (very narrow, very clear)

This “single question → single page” pattern is repeatedly echoed by operators discussing what performs better in AI retrieval contexts.

Week 3: Expand third-party trust

- strengthen review profiles

- publish 1–2 credible thought-leadership placements

- partner ecosystem mentions

- consistent brand facts across key directories

Week 4: Improve conversion readiness

Update pricing/industry pages to include:

- “who it’s for / not for”

- common objections

- proof + security/compliance callouts

- FAQs that map to evaluation prompts

Common mistakes (what not to do)

- Don’t chase “AI hacks.” Focus on being genuinely credible and evidenced.

- Don’t publish broad fluff. Clarity and structure win more often than long intros.

- Don’t treat AI visibility as only content. Third-party trust surfaces matter.

If you’re reading this and thinking, “Cool… but how do I track 50 prompts across models, measure share of voice, and not lose my mind in spreadsheets?”— you’re not alone.

That’s literally why we built Atlas: to help teams monitor how (and where) their brand shows up in AI answers, track visibility over time, and turn “we should show up more” into a measurable system.

Take a look if you want the faster route:https://www.pepper.inc/product/atlas/

Bottom line

If you sell in the U.S. and compete in a researched category, AI visibility is becoming a real discovery layer—not necessarily bigger than SEO today, but influential earlier in the buyer journey.

The best investment isn’t a “GEO sprint.”

It’s a measurable system: prompts → evidence-backed pages → third-party credibility → decision-page conversion.

That’s how you become not just visible, but citable.